At FCA Corp, we deeply admire and support Rice University’s healthcare innovation efforts to support individuals and families in underserved communities and resource-limited countries. As a Texas-based holistic wealth management firm with decades of experience investing in Africa and other frontier markets—both directly and through our global mutual funds—we have seen firsthand the urgent need for healthcare and the innovation required to reach economically challenged populations facing significant barriers.

We are proud to be proactive sponsors of Rice360 Institute’s innovation competitions and conferences, including:

The Rice360 Institute for Global Health Technologies 15th Annual Undergraduate Global Health Technologies Design Competition

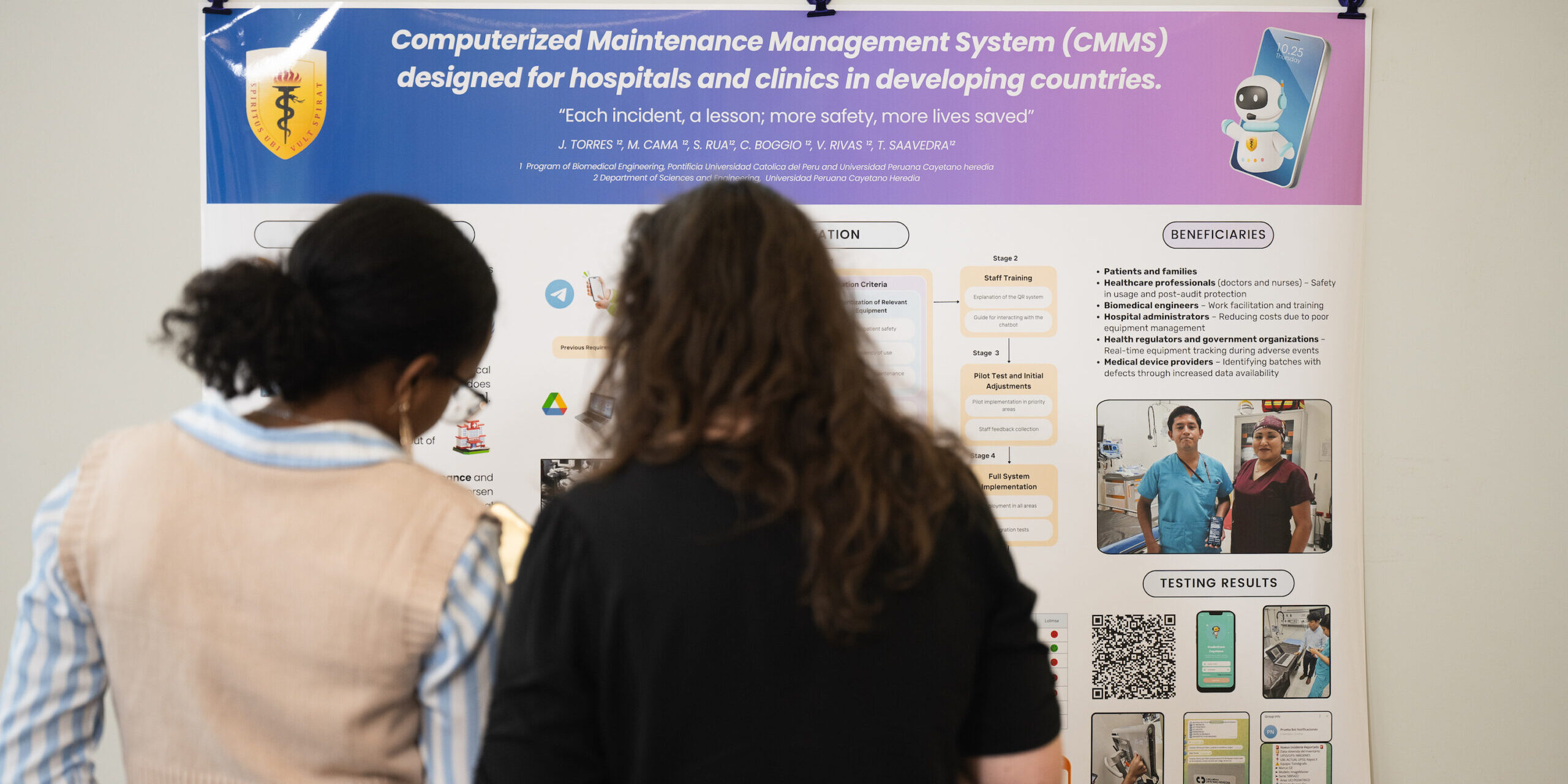

The Rice360 Institute for Global Health Technologies hosted its 15th Annual Undergraduate Global Health Technologies Design Competition on April 11, 2025, at Rice University in Houston, Texas, with virtual participation options. The competition featured national and international student teams presenting low-cost technologies aimed at addressing health challenges in resource-limited settings. Projects were judged on the clarity of the problem definition, the effectiveness and potential impact of the design, and the feasibility of implementation in low-resource environments.

The Rice360 Institute Innovation for Day One Conference

The Rice360 Institute’s Innovation for Day One Conference, held on September 2024 at the Bioscience Research Collaborative on Rice University’s campus in Houston, focused on advancing treatments and technologies to save mothers and newborns during birth and the first 48 hours postpartum—when the risk of death is highest. The conference emphasized immediate impact and prioritized innovations aimed at ending preventable maternal and newborn deaths in underserved and resource-limited settings worldwide.

Robert Scharar, Founder and CEO of FCA Corp and President and Portfolio Manager of Commonwealth International Series Trust, shared practical insights from his on-the-ground experience at the Day One Conference on how new ideas and businesses evolve in emerging markets. To further support all these innovative ideas and applications developed through these competitions and conferences, he emphasized how targeted investments and thoughtful business strategies can serve as powerful tools to drive innovation and positive change.

Below are excerpts from his talk, offering key perspectives on implementing innovation on the ground in emerging markets:

“I strongly believe that as investors, we have an important role to play in emerging markets and resource-constrained communities. This requires reinvesting in the local community and by helping to expand access to basic needs like health care, food supply, energy, and education – it also creates consumers for a wide variety of products and services.

My experience has taught me that you first have to be clear as to what are the obstacles that you face in funding and creating businesses in emerging countries. These obstacles to funding new ideas and solutions and bringing them to implementation include:

- Over-reliance on grants and government funding which are often detached from commercial reality

- Emerging market lenders are “fixed asset oriented” requiring collateral which these innovators do not have – lenders need to consider knowledge as collateral

- High interest rates and lack of access to hard currency

- Lack of early-stage, angel fund investment pools

- Government interference, regulatory burdens, and compliance costs

- Too few mentors as new business founders need mentors and role models

- Lack of interdisciplinary collaborations on the ground – too many silos between organizations

- Everyone likes and needs your idea, but no one wants to pay for it

Ways we have found to overcome these obstacles:

- Identify the stages of development, product commercialization path, and what resources are needed for the idea or innovation creation.

- Create mentoring teams involving academic and professional advisors, such as CPAs, attorneys, and industry advisers.

- Motivate academic, health institutions, government agencies, and private sector interaction and cooperation.

- Create a “virtual” entity for the innovation at the early stages to minimize overhead and paperwork to “incubate” ideas.

- Raise funds in the emerging market on a country or regional basis to vet, fund, and monitor opportunities.

- Include local financial institutions, pension plans, foundations, and government as funding sources.

- Advocate for more business training at the local University and community level for those who choose to study the sciences, engineering, and social services as few receive any training on free enterprise, capitalism, and the need for returns on investments.

- Develop robust local relationships with the community

To make things happen faster, you have to develop a simple funding concept other than traditional loans, which may entail the funder receiving a royalty, the loan being repaid as a percentage of each item sold, forming a new company with equity ownership by the funders and inventor, having the funder directs charitable gifts of the invented product as part of its return, and/or part of the loan may be forgiven based on milestones achieved.

It is further needed to carefully monitor, provide strategic support, and encourage that funding should be tied to the borrower having a support team, require light but meaningful paperwork and reports, networking with other borrowers, promote marketing, and build media support.”

Our investment mission at FCA Corp and our Commonwealth International Series Trust mutual funds – through practical decades-long global experience – has taught us how investment managers can be important supporting partners with portfolio companies in scaling up and commercializing innovation and to enact change in practices, policies, and infrastructure that can chart a path forward.

Disclaimer: This article is for informational purposes. Nothing contained herein constitutes investment advice or the recommendation of or the offer to sell or the solicitation of an offer to buy or invest in any specific investment product or service. Before investing you should carefully consider the investment’s objectives, risks, charges, and expenses. This and other information can be obtained through contacting the following: https://fcacorp.com/investment-management. Please read the prospectus and other investment documents carefully before you invest. Investing involves risk including the possible loss of principal. Rice University.